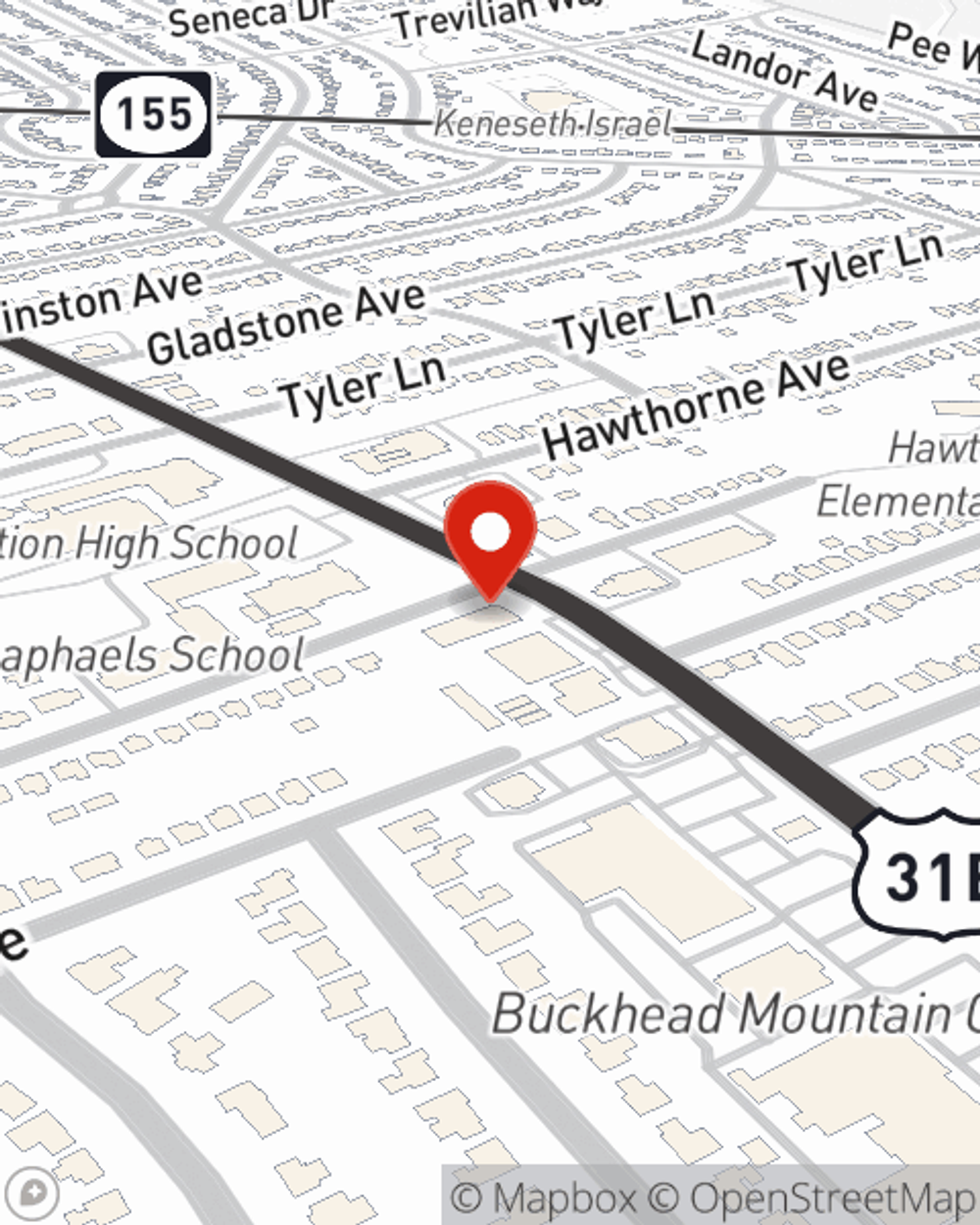

Business Insurance in and around Louisville

One of the top small business insurance companies in Louisville, and beyond.

Helping insure businesses can be the neighborly thing to do

- Louisville

- Jefferson County

- Oldham County

- Shelby County

- Highlands

- Seneca

- Germantown

- Nulu

- Bullitt County

- Spencer County

- Old Louisville

- St. James

Insure The Business You've Built.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Sam Wheeler. Sam Wheeler can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

One of the top small business insurance companies in Louisville, and beyond.

Helping insure businesses can be the neighborly thing to do

Strictly Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your take-home pay, but also helps with regular payroll expenses. You can also include liability, which is vital coverage protecting your business in the event of a claim or judgment against you by a customer.

Get in touch with State Farm agent Sam Wheeler today to explore how one of the leading providers of small business insurance can ease your business worries here in Louisville, KY.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Sam Wheeler

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.